Brix

Brix is application that includes all aspects of the movement

of customs and excise goods into, from and through the EU customs territory.The application contains 25 years of experience in

developing software solutions in the area of customs clearance business.The success of the solution is measured by over 500 customs clearance agents,

freight forwarders, logistics and trade companies using it.The application is modular, configurable and constantly enriched with new functionalities.

It is always in line with the amendments of laws and regulations.

It is a product widely embraced amongst users thanks to its

functionality, ease-of-use and short learning curve.

Tailored to suit the user

Business centric application

- A fast and efficient application due to the simple user interface and innovative technological solutions,

- modular and configurable,

- verifies all documents before submitting it in accordance with the rules and conditions,

- includes a TARIC validation,

- items from imported electronic invoices instantly classified into declaration items,

- familiar with customs and other procedures,

- calculates all customs fees and taxes,

- automatically and silently refreshes the application, valid code tables and accompanying documents,

- daily update of TARIC, exchange rates, certificate and customs offices list,

- enables the direct exchange of electronic messages with customs systems and other state bodies and agencies.

- Supports any spatial, organizational and IT company structure,

- integrates with other business applications, as well as with the user's ERP system, using a standard or default definition for data import and export (XML, XLS, CSV, PDF),

- offers detailed reports on operations based on employees, business offices, customs procedures, etc.,

- supports multiple languages,

- follows the AEO guidelines,

- enables the use and creation of a goods library and catalogue,

- integrated service invoicing (offers, invoices, reports),

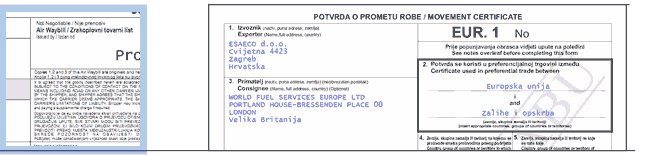

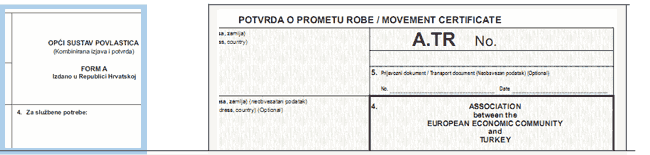

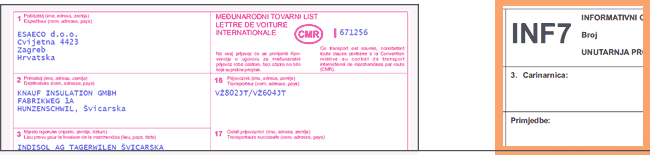

- enables the creation of accompanying documentation (EUR.1, CIM, CMR, A.TR, licences, etc.),

- a hierarchical right to data access and documents through a versatile authorization system in order to:

- access documentation and reports,

- access business offices,

- access reference data.

eFolder

A central place where all documents related to a single business operation are stored.

- The document holder of the operation: customs declaration, Intrastat report, EMCS excise documents,

- with each electronic document, all the electronic messages exchanged with the customs or competent bodies are archived,

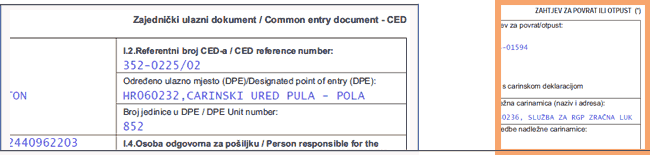

- produced documents intended for the customs and competent bodies created at the office during the customs clearance procedure (D.V.1, EUR.1, CIM, CMR, licences, etc.),

- received as accompanying documents with goods (Consignor/Exporter invoice, CMR, EUR.1, etc.),

- documentation intended for other clients or received from other clients (agent authorization, calculation of taxes, etc.),

- invoices created for the performed service,

- from the Windows system, documents can be imported in eFolder in any format,

- documents can be e-mailed, printed or exported from eFolder.

-

eFolder ..

-

Declarations and invoices offers, document draftseFolder combines all the documents related to a single business case.

-

Archived electronic messages XML, electronically signed documentsArchive of all electronic messages sent or received by the state administration body.

-

Sender and recipient documents XML, PDF, CSV, TXT, scanInvoices, bills of lading, certificates of origin, certificates. Export for ERP and import.

-

Other following documents Requirements, Statements, Requests, SpecificationsOther supporting documents issued in the proceedings. PDF, RTF.

Over a dozen prepared forms

The basic application also comes with accompanying forms and documents in the prescribed form necessary for the application of regulations related to the customs procedure the goods were declared for. The entry forms – templates – are used to transfer data from previously entered customs declarations.

The accompanying documents includes entry forms in PDF format, with a prescribed form and fixed content with integrated code tables and instruction on how to fill in the forms. The collection contains more than 50 forms:

- annexes to the Regulation establishing the Community Customs Code (binding classifications, economic impacts, INF forms, simplification, requests and certificates, etc.),

- movement certificate / certificate of origin (EUR.1, FORM A, ATR, T2, T2L, etc.),

- inspection control (FITO, CVED, CED, sanitary and veterinary examination forms),

- bills of lading and specifications (CIM, CMR, etc.).

Administrative and personalized templates

For documents with no prescribed form but with required minimal content, a group of Administrative documents in RTF was created. These templates can be created by the user with the minimum skill and effort.

Authorized Economic Operator

Authorised Economic Operator (AEO) is an economic operator who is reliable in the context of its own procedures related to customs and therefore is entitled to enjoy benefits. Examples of such benefits: fewer physical and document controls; priority, if consignments are selected for control; option of the place where controls will take place etc. Economic operators can obtain two status simplifications: AEOC – Customs Simplifications and AEOS – Security and Safety.

The legal framewok for the Authorised Economic Operator Programme is contained in the Union Customs Code (UCC) and its Implementing Provisions.

- Union Customs Code (UCC): Regulation (EU) No 952/2013 of the European Parliament and of the Council of 9 October 2013.

- Union Customs Code Implementing Act: Commission Implementing Regulation (EU) 2015/2447 of 24 November 2015.

- Union Customs Code Delegated Act: Commission Delegated Regulation (EU) 2015/2446 of 28 July 2015.

Guidelines

The existing guidelines for obtaining the AEO status (TAXUD/B2/047/2011 – Rev.6) recommend using the Self-assessment questionnaire.

This questionnaire helps a potential candidate obtain the AEO status by establishing how much the candidate's procedures, organisation and practice enable shipment security in all of the stages of its “life cycle”: production, transportation, delivery, forwarding, acquisition and storage, import, export, transit and other.

Brix is the ultimate IT support for fulfilling the AEO criteria in relation to:

- complying with customs regulations in the previous period,

- keeping business records in a satisfactory manner,

- fulfilling specific security and safety standards.

Brix and fulfilling criteria for obtaining AEO status

| Article of the UCC's Implementing regulation | Required functionality | Description | Brix application functionality |

|---|---|---|---|

| 24.1 | PREVENTIVE MEASURES TAKEN FOR REDUCING THE NUMBER OF ERRORS | The record of compliance with customs requirements shall be considered appropriate if over the last three years preceding the submission of the application, the persons described in items (a) to (c) have not committed any serious infringement or repeated infringements of customs legislation and taxation rules. |

Brix enables centralised and hierarchical database editing on articles and/or goods that are the subject of customs procedures. By using an environment organized in such a way where authorised users or teams classify goods according to the Combined Nomenclature, there is no more need for the daily, repeated classifying goods that, in turn, reduces the possibility of errors. An inbuilt system for verifying input data ensures that the documents are in accordance with the rules and conditions, as well as the formal requirements prior to entering documentation into the eCustoms system. Apart from the rules prescribed in the Act and implementing regulations, Brix warns users of potentially incorrectly entered data (e.g. verification of the net weight in relation to the quantities in supplementary units such as litres, kilograms, kilograms net drained weight, cubic meters, etc). A system of daily referent data updates – TARIC and of code lists, as well as application upgrades in compliance with the Act ensure compliance with the customs regulations. |

| 25.1 (a) | FACILITATING CUSTOMS BOOKKEEPING CONTROL | The applicant has to maintain an accounting system that is consistent with the generally accepted accounting principles, allows audit-based customs control and maintains a historical record of data that provides an audit trail from the moment the data enters the file.. |

An operation log is used for recording, enabling the traceability of data from the moment it was entered into the data system to the moment it left the system. Each document has its own time traceability based on the following criteria: employee, performed activities (created, changed, printed, sent via e-mail, etc.) and the time of the performed activity. Apart from these elements, each electronically signed document exchanged with the customs or other state institutions has archived messages from the first sent message to the last exchanged message in accordance with the prescribed procedure. The inheritance of data from the declaration, or IE messages in the service invoice, creating predefined items and contract elements reduces the possibility of errors in drafting financial documentation. Connecting with the user's ERP application and the automatic transfer of service invoices and other financial data into the bookkeeping system eliminates any possibility of errors that would have occurred during copying. |

| 25.1 (d) | THE POSSIBILITY OF CUSTOMS VERIFICATIONS | The applicant is obliged to allow the customs authority physical or electronic access to its customs and transport records. |

The customs authority of any EU Member State can be given electronic access, review and analysis of all electrically signed declarations, alongside which the following paperwork can be found in eFolder:

|

| 25.1 (h) | ARCHIVING PROCEDURES | The applicant is obliged to have satisfactory procedures in place for archiving records and information and for protection against the loss of information. |

Brix allows the user to see the records on making backup copies of databases. At the same time, the application warns if there are any irregularities. The messages are clearly displayed on the user interface. By placing the database on the Cloud service, where high system availability, information security and multiple backup copies are ensured with some of the safety-data centres authorized and standardized in accordance with the information security standard (ISO27001:2013). Brix has no time limit for data keeping. The manufacturer proposes the best options through an individual approach, after performing a risk analysis or damage analysis. |

| 25.1 (j) | COMPUTER SYSTEM SECURITY | The applicant is obliged to have appropriate information security measures in place to protect the applicant's computer system from unauthorised intrusion and to secure applicant’s documentation. |

The application ensures fine grained data access control. Administrative role that comes with the highest authority ensures access control and authority level for all other application users. In this way, the information security officer has complete control over sensitive data access. The company's own organization structure is defined, application users are categorized into groups and licences and the rights of application users are determined on all levels. Database access is protected by two separate authentication levels. Using the database on the server (administration / system works), authentication requires the use of a username and password combination that is different from the combination for using data from the database through the application. |

The basis of the installation is the Core installation

used to install application modules.The core is the equivalent of an operating system on a computer.

Brix (the core) is installed on an actual computer.

During a switch of computers, a licence warning is activated,

after which the user contacts the Nova ICT user support in order to reactivate.

The application core functionalities

- Access and insight into all created documents (print, e-mailing, print preview, export),

- access to all business offices, users and reports existing within the company,

- silent Update & Upgrade service for the automatic refreshing of referent data, documents and application,

- full access to TARIC service,

- access to and the possibility of editing all local user code tables (business partners, goods catalogues and libraries, etc.),

- drafting new templates for Administrative (accompanying) documentation,

- creating new accompanying documents and the possibility of editing existing documentation.